Comments, Analysis, Data, and News on Turkish Economy

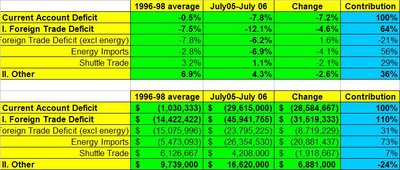

It is good to see that somebody is paying attention to the reasons behind Turkey's high CAD in recent years. To clarify the point further I put a small table below that gives you the breakdown of the CAD. If the energy prices were at their 1996-98 rate, the CAD would be 2.6%. The net contribution of trade deficit to the CAD is in fact negative , once energy imports are excluded. In the second table, we can see that although the CAD has increased by 29 billion dollars, rise in energy imports explains 21 billion dollars of that.If the decline in commodity prices is a trend shift, Turkey stands to benefit a lot. The shock of soaring commodity prices has been a major contributor to Turkey’s inflation and current account troubles. This is of course not surprising, given its growing dependence on imported sources of energy.... [N]et energy imports surged from 4.4% of GDP in 2003 to 5.2% in 2005 and 6.5% this year, accounting for more than 70% of the worsening in the current account deficit from 4.4% of GDP in 2003 to 7.4% this year. This is why we have always been careful about passing judgment on external imbalances of the Turkish economy.

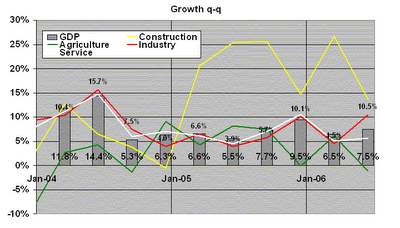

"Economic growth has been strong so far in 2006, but a sharp weakening of the lira in May-June, accompanied by higher inflation and monetary tightening by the Central Bank of Turkey, will lead to a slowdown in the second half of this

year and the first half of 2007. GDP growth is forecast to be 4.5% in 2006 and about 4% in 2007. " (Economist, August 21 2006).

Yogi Berra once said "Prediction is very hard, especially about the future!"

But, come on! Just look at the statistics as of Aug 15 for God's sake.

Of course, this is the same magazine that predicted a recession in Turkey at the beginning of 2004 ...the growth rate, it turned out, ended up 9 percent.

Update (Sep 13): GDP growth: 2006Q2: 7.5%, 20061H: 7.0%

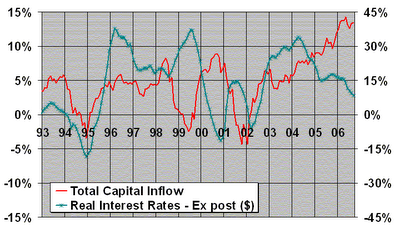

Raghuram Rajan, who is the head of research department at IMF caused quite a debate in Turkey with his recent speech at a conference in Wyoming (bad boy!). In sevral op-eds prominent Turkish economists cited that speech to prove the virtues of (semi) closed economy over an open one that allows free movement of capital.

What did Dr. Rajan said in Wyoming (home of the VP Cheney. Hmmm?)

Our conclusion is therefore that in the long run, capital account opening is unlikely to help poor countries grow by providing resources in excess of what is available in the domestic economy.

Countries that use less foreign finance, or export more savings, grow faster.Countries that invest more grow more than countries that invest less; but it is countries that invest more and save more (that is rely less on foreign capital) that do the best of all. In fact, within countries that invest more, those that save more (and thus run lower current account deficits) grow at a rate of about 1 percent a year more than countries that save less.

We find ... that controlling for domestic savings in our baseline regression eliminates the effect of the current account on growth but controlling for investment does not.

All this suggests that domestic savings rather than foreign savings are critical for growth.

In other words, it is good to save more and invest it. (You go Robinson Cruiso!). On the other hand, if for a variety of reasons you are not able to increase your savings (which is the case in Turkey), then what is your best course of action? I say let's borrow the savings of other countries and invest it to increase production capacity (but use that money wisely because you are going to pay it back with interest). This is the second-best option and in fact only option that we face in Turkey given that we are living in a democratic society and our elected leaders are likely to be reluctant to commit suicide by forcing their constituencies to adopt a China like savings rate.

Let me give a few numbers:

If you do not like this scenario, you only have two alternatives:

How can we raise productivity? With more competition, new technologies, new business practices. In other words establish the rule of law in the country, cut the red tape, reduce corruption, invest on the infrastructure of the country, prevent oligopolistic business practices, create a competitive business environment, and of course attract more foreign direct investment.

Until then, the country needs foreign capital to grow.

ABSTRACT

We compile the list of articles published in major refereed economics journals during the last 35 years that have received more than 500 citations. We document major shifts in the mode of contribution and in the importance of different sub-fields: Theory loses out to empirical work, and micro and macro give way to growth and development in the 1990s. While we do not witness any decline in the primacy of production in the United States over the period, the concentration of institutions within the U.S. hosting and training authors of the highly-cited articles has declined substantially.

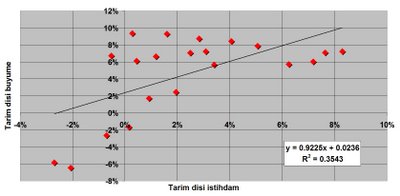

Two questions come to my mind: Are we witnessing a radical structural change in the job market? Is there something wrong with the statistics on agricultural employment valid?

The numbers are suspicious for the following reason: Almost all positive growth rates in agricultural employment came when the economy is in recession: 1991, 1994, 1999, 2001. Is it possible that those people who supposedly work in the agriculture sector realy work or they just return to their villages when the economy is in trouble?

Let's look at the simple correlation between the variables, first: :

Employment Growth in Agriculture vs. Production Growth in Agriculture: 0.02

Growth in Nonfarm Employment vs. Growth in Nonfarm Production: 0.26

Employment Growth in Agriculture vs. Growth in Nonfarm Production: -0.42

Let's put the numbers in a chart, where this negative relationship between nonfarm production growth (y-axis) and agricultural employment growth (x-axis) is easily observable:

Lesson 1: Better to look at nonfarm employment because there is something fishy in agricultural employment data.

In the next graph, we look at the relationship between nonfarm employment growth (blue line) and nonfarm production growth (red line). The link is more stable and significant, but still there is something wrong with the figure. In particular, look at 1994 and 1999. Although the country fell into depression in these periods, the economy continued to create nonfarm jobs!!! How can this be possible?

My explanation is the changes in the household survey (the only data source on employment in Turkey), especially in the sample size and the methodology.

The State Institute of Statistics started to conduct households surveys on a bi-annual basis in 1988. In 2000 the HH survey methodology was updated (sample size was doubled, and the coverage was extended to other regions of the country). Between 2000 and 2005 survey cycle was reducted from 6 to 3 months. In 2005 the HH survey was updated once again to make it compatible with Eurostat standards. Number of regions covered was raised from 7 to 26 and sample size by 50%. Starting in Jan2005, HH survey has conducted each month.

Lesson 2: You can rely more on 2000-2005 numbers than 1998-2000, and more on 2005- numbers than 2000-2005.

Let's focus on 2000-2006 period and update our simple correlation table:

Employment Growth in Agriculture vs. Production Growth in Agriculture: -0.40

Growth in Nonfarm Employment vs. Growth in Nonfarm Production: 0.60

Employment Growth in Agriculture vs. Growth in Nonfarm Production: -0.37

And also update the previous figure as well (nonfam job growth on the x-axis, nonfarm production growth in the y-axis):

This is the picture of so-called "jobless growth".

Data Source