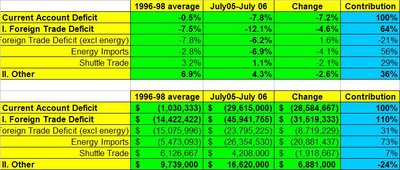

It is good to see that somebody is paying attention to the reasons behind Turkey's high CAD in recent years. To clarify the point further I put a small table below that gives you the breakdown of the CAD. If the energy prices were at their 1996-98 rate, the CAD would be 2.6%. The net contribution of trade deficit to the CAD is in fact negative , once energy imports are excluded. In the second table, we can see that although the CAD has increased by 29 billion dollars, rise in energy imports explains 21 billion dollars of that.If the decline in commodity prices is a trend shift, Turkey stands to benefit a lot. The shock of soaring commodity prices has been a major contributor to Turkey’s inflation and current account troubles. This is of course not surprising, given its growing dependence on imported sources of energy.... [N]et energy imports surged from 4.4% of GDP in 2003 to 5.2% in 2005 and 6.5% this year, accounting for more than 70% of the worsening in the current account deficit from 4.4% of GDP in 2003 to 7.4% this year. This is why we have always been careful about passing judgment on external imbalances of the Turkish economy.

No comments:

Post a Comment