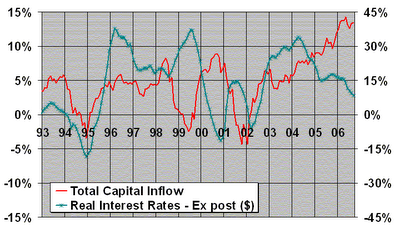

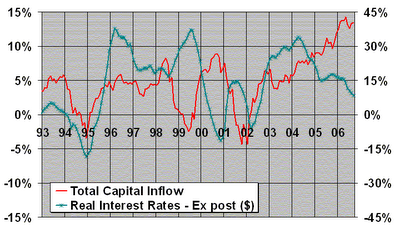

Graphics below show

- the total capital inflows to Turkey (as % of GDP, 12 month moving average, left axis),

- decomposition of inflows (as % of GDP, 12 month moving average, left axis)

- the real interest rates in Turkey (in $ terms, ex-post, 12 month moving average, including currency appreciation, in right axis).

Notes

Notes:

(1) interest rate: dollar terms, ex-post, right axis

(2) capital flow: as % of gdp, left axis

(3) government borrowing (% of gdp, left axis, bonds issued abroad, IMF credits, other credits --- excluding Treasury domestic borrowing securities)

(4) hot money linked to interest rates (% of gdp, left axis, Treasury domestic borrowing securities, short term borrowing of banks, short term borrowing of other sectors, deposits, net errors and omissions, excluding stock purchases)